Financial dashboards & reports provide at-a-glance status of your business’ financial health and allows key financial executives to make sure that your business’ finances are running smoothly, identify any issues upfront and fix them as quickly as possible.

Financial Dashboards & Reports : Benefits, Examples, KPIs, Metrics

What is a Financial Dashboard?

Financial dashboard is a visual collection and representation of the key financial metrics & KPIs needed to monitor the financial health of your business.

They are useful for CFOs, VPs, Financial managers who need to regularly monitor the financial performance of your business.

Financial dashboards automatically collect, consolidate, analyze and report financial data point from various systems and processes. So it provides a single point of control for your financial team, and helps them make better decisions.

Bonus Read : CTO Dashboards & Reports : Benefits, KPIs & Metrics

What is a Financial Report?

Financial Reports are static versions of Financial dashboards. While financial dashboards are dynamic and show live data, financial reports are a snapshot of financial performance.

Also, they are more summarized than Financial dashboards since they are static in nature.

In most cases, Financial reports are PDF exports of Financial dashboards that are automatically emailed to key stakeholders and decision makers who are busy and can’t regularly check live dashboards.

In some cases, businesses use Financial Reports interchangeably with Financial Dashboards. However, financial dashboards are reviewed often while financial reports and reviewed once in a while.

Bonus Read : How to Create Operational Dashboards

Benefits of Financial Dashboard

Here are the key benefits of financial dashboard. They

- Provide single point of information about business finance

- Collect and report data from diverse data sources

- Simplify and present data visually

- Send automatic alerts in case of issues

- Send automated email reports to key stakeholders

- Provide at-a-glance status of vital finance stats

- Can be accessed anywhere, anytime, on any device

Bonus Read : Top 5 SaaS KPI Metrics You Should Monitor

How to Create Financial Dashboards and Reports

Here are the steps to create Financial dashboards and reports.

1. Understand Your Target Audience

It is important to clearly identify your target audience for your financial dashboards and reports. They may be CFOs, VP Finance, Financial Manager, etc. Different people look for different kinds of information. For example, a CFO will need high-level comprehensive summary about all financial systems and processes. On the other hand, a financial manager may be interested only in the department or project he is in-charge of.

2. Identify Financial KPIs and Metrics

Next, it is important to clearly identify the financial KPIs and metrics to be displayed on your dashboards. Conduct 2-3 meetings with your target audience to understand their business goals & objectives. Find out what metrics they use to measure performance against goals. Also, ask them if there are any additional KPIs they would like start tracking.

Also, understand how they need this information to be delivered (via email, PDF, portal, etc) and how frequently.

Finance can become complicated at times, and KPIs help to understand and analyze these financial complications for any business. Not only they can help businesses make profit but also they are great to understand customer behavior and staying relevant in the market. And if you want to sustain your business in the market you need to keep track of these essential financial KPIs.

3. Design Dashboard Mockup

Use a dashboard software to quickly mock up your dashboard design. Organize your KPIs and metrics in 3 layers. The most important and urgent KPIs at the top, with trends and distributions in the middle, and granular details at the bottom.

Choose the right visualization for each financial metric to avoid confusing your audience. Conduct 2-3 meetings with stakeholders and decision makers to review your dashboard mock up, get sign off and start building your dashboard.

Financial KPIs and Metrics

Here are the key Financial KPIs and Metrics you must track on your Financial dashboards and reports.

1. Gross Profit Margin

Gross Profit Margin measures what percent of revenue is profit.

Gross profit margin = (revenue earned – costs of goods sold) ÷ revenue

2. Net Profit

Net Profit is basically what you are left with after deducting all expenses from your total revenue.

Net Profit = Total Revenue – Total Expenses

3. Net Profit Margin

Net Profit is similar to Gross Profit Margin, and tells you what percent of your revenue, is profit. However, in this case, you need to include all expenses such as fixed costs, overheads, salaries, etc. in addition to cost of goods.

Net profit margin = (total revenue – total expenses) ÷ total revenue

4. Current Ratio

Current Ratio is a very useful metric that allows you to measure the liquidity of your business. It is basically the ratio of your total assets to total liabilities.

Current ratio = current assets ÷ current liabilities

Tracking Current Ratio helps you understand if you will be able to make big investments, and also get a good line of credit.

5. Account Receivables

Account Receivables are all the pending invoices and memos that you have not been paid so far. If your business accumulates too many account receivables then it will face a liquidity crunch. So it is important to keep track of all pending receivables.

Financial Dashboard Examples

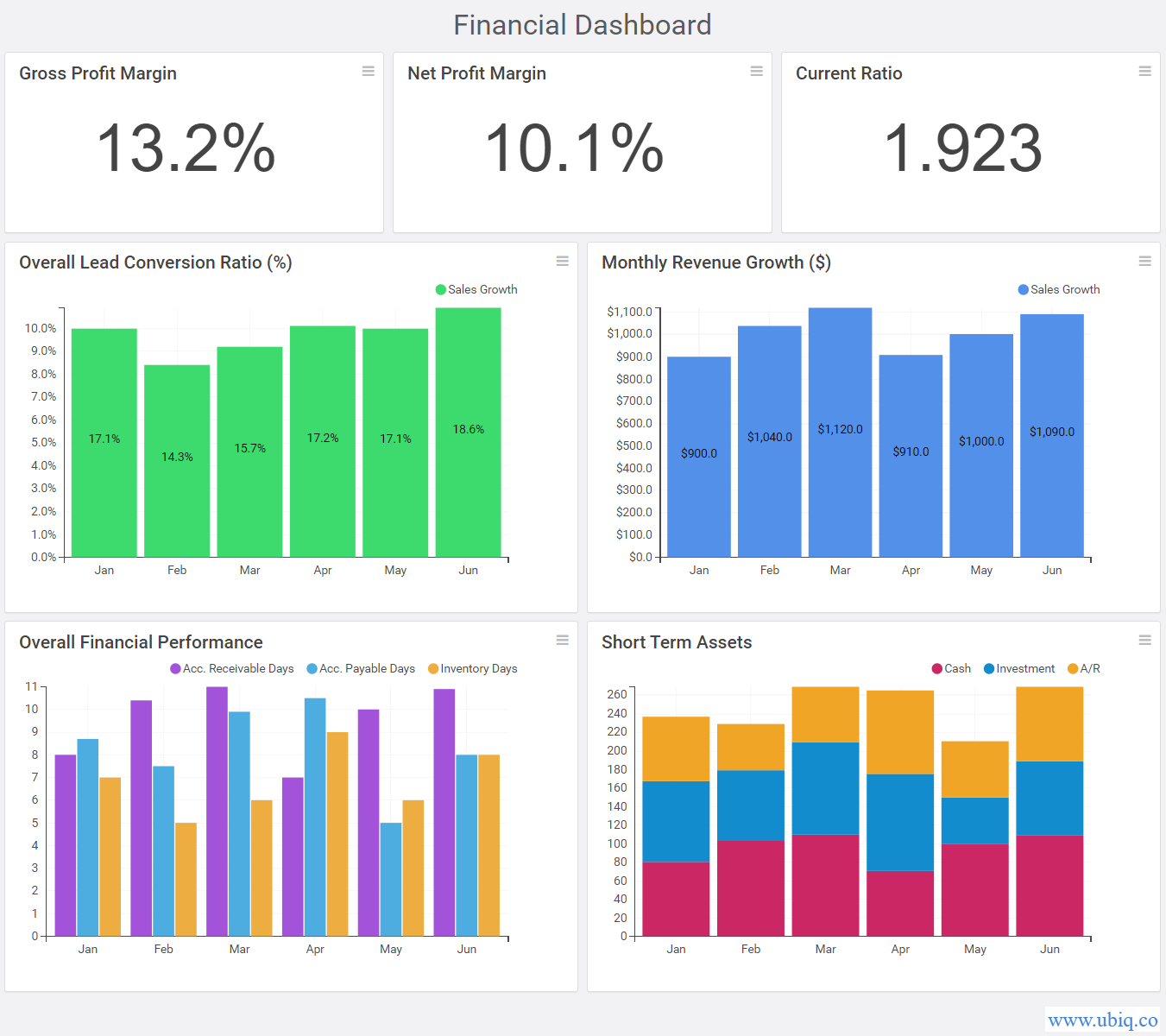

Here’s an example of financial dashboard created using Ubiq.

Ubiq makes it easy to visualize data in minutes, and monitor in real-time dashboards. Try it Today!

Sreeram Sreenivasan is the Founder of Ubiq. He has helped many Fortune 500 companies in the areas of BI & software development.